Organizations that handle a number of tasks want to grasp the venture prioritization scoring mannequin. And not using a venture scoring matrix to assist them choose the tasks that align with their enterprise objectives and when to implement them, they’re not managing however leaving every little thing to destiny.

That’s not a superb place for a enterprise to be. Subsequently, we’ll outline a scoring mannequin in venture administration and when to make use of venture scoring. Then we’ll clarify the venture consumption course of, why it’s vital to ascertain a weighted scoring mannequin in venture administration and checklist the differing types.

What Is a Venture Prioritization Scoring Mannequin?

A scoring mannequin in venture administration is a structured technique organizations use to judge and rank potential tasks based mostly on standards. The aim is to assist decision-makers prioritize tasks that can deliver essentially the most worth to the group, contemplating assets, time, dangers and different elements.

The venture prioritization scoring mannequin assigns scores to tasks based mostly on their alignment with strategic objectives, anticipated advantages and feasibility. Key components embody a set of things or dimensions that the venture will likely be assessed towards, reminiscent of strategic alignment, anticipated return on funding (ROI), useful resource availability, threat, affect on stakeholders and urgency.

Every criterion is assigned a weight based mostly on its relative significance to the group. Tasks are scored towards every criterion, the rating reflecting how properly the venture performs regarding every criterion. Then tasks are ranked based mostly on their whole rating, with the highest-scoring tasks usually being the best precedence.

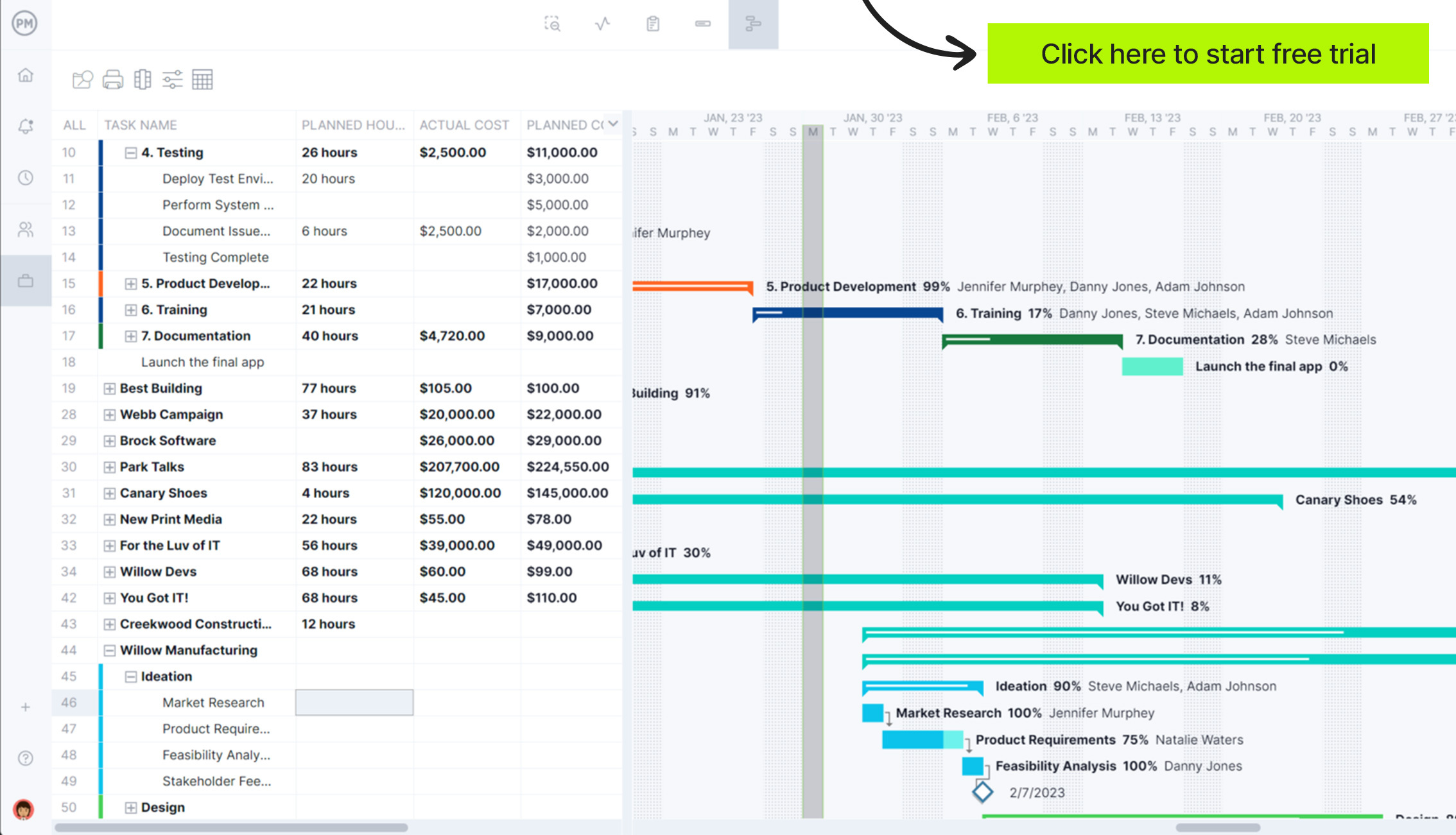

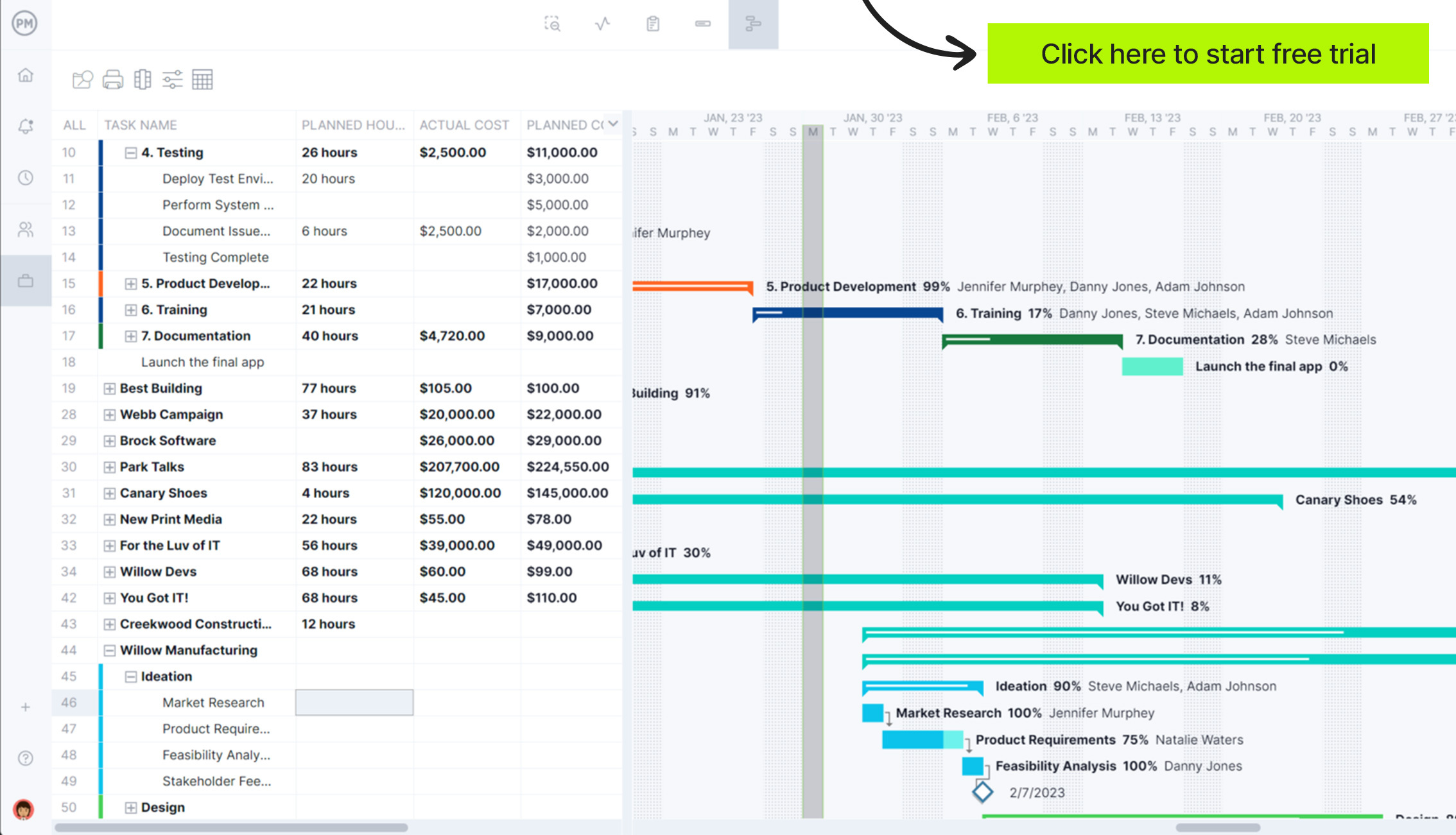

The venture prioritization scoring mannequin can assist in choosing tasks, however as soon as that’s finished the true work begins. That’s when venture administration software program is required. ProjectManager is award-winning venture and portfolio administration software program that has strong portfolio roadmaps that acquire all of the tasks in a portfolio and reveals them on a Gantt chart that may handle assets, monitor time and handle duties in actual time. Get began with ProjectManager right now without cost.

When to Use a Venture Prioritization Scoring Mannequin

A venture scoring matrix is especially helpful when a corporation wants to judge and rank a number of potential tasks to make choices about useful resource allocation, funding and strategic focus. This may be when there are restricted assets, a number of competing tasks, the necessity for strategic alignment, altering market or enterprise circumstances, venture portfolio administration, decision-making beneath strain, stakeholder engagement, efficiency analysis and introducing new initiatives. Let’s take a better have a look at a few examples.

The Venture Prioritization Scoring Mannequin & the Venture Consumption Course of

Throughout the venture consumption course of, numerous stakeholders submit venture requests. These submissions usually embody a quick venture description, aims, anticipated outcomes, useful resource necessities and timeline estimates. A scoring mannequin in venture administration is used to judge every venture towards predefined standards, reminiscent of alignment with strategic objectives, anticipated ROI or worth, useful resource availability, threat and complexity, urgency or timing and feasibility.

The tasks are then ranked based mostly on the entire weighted scores. This helps create a prioritized checklist of tasks, with the highest-scoring tasks thought-about essentially the most priceless or aligned with enterprise aims. Senior management or a venture steering committee critiques the ranked tasks and should make remaining choices based mostly on the scoring mannequin outcomes, in addition to different sensible concerns. The tasks with a excessive rating that match the factors are permitted and others are rejected.

Product Improvement & the Venture Prioritization Scoring Mannequin

Product concepts or options usually come from numerous sources, reminiscent of prospects, inside stakeholders, market analysis or rising applied sciences. A venture scoring matrix can assess these concepts based mostly on a sequence of standards that replicate the corporate’s objectives and the product’s aims. Standards can embody buyer affect, income potential, market demand, strategic alignment, aggressive benefit, technical feasibility, useful resource availability, threat or complexity and time to market.

Every criterion is weighted in accordance with its significance to the group and the product. Every product thought or function is then evaluated and scored in accordance with the outlined standards. As soon as every product thought or function is scored, the scores for every criterion are multiplied by the burden assigned to that criterion. The outcomes are summed to provide a complete rating for every thought or function. Now, the product improvement group can rank the concepts or options based mostly on precedence. That is reviewed and adjusted as new info turns into out there.

Why Is It Vital to Set up a Scoring Mannequin for Venture Prioritization?

Establishing a venture prioritization scoring mannequin is crucial for organizations to successfully handle their portfolios and make knowledgeable, goal choices about which tasks to pursue. Listed here are extra the reason why a venture scoring matrix is vital.

- Ensures strategic alignment throughout tasks, packages and venture portfolios

- Helps prioritize the allocation of restricted organizational assets to essentially the most priceless tasks for the group

- Facilitates controlling threat in venture portfolios by assessing the potential dangers and advantages of venture proposals

- Permits venture stakeholders to simply perceive why venture proposals are accepted or rejected

- Accelerates the venture consumption course of by standardizing the venture choice and prioritization course of

- Helps decision-makers make goal, unbiased choices and offers transparency for the venture consumption course of

Forms of Venture Scoring Fashions

Organizations use a number of forms of venture scoring fashions to prioritize tasks based mostly on particular standards. Every mannequin offers a structured, goal solution to assess and examine tasks. Under are some widespread varieties.

Weighted Venture Prioritization Scoring Mannequin

This is among the most generally used venture prioritization fashions. It includes evaluating tasks towards a set of standards, by which every criterion is assigned a weight based mostly on its relative significance. Every venture is then scored on a scale for every criterion, and the scores are multiplied by the burden of every criterion. The entire rating is calculated by summing the weighted scores for all standards and tasks are prioritized based mostly on their whole scores. Examples of standards are as follows.

- Return on funding

- Payback interval

- Web current worth

- Strategic alignment

- Anticipated effort

- Potential advantages

- Useful resource availability

- Potential dangers

- Buyer affect

Eisenhower Matrix or Venture Prioritization Matrix

This straightforward however efficient software was popularized by US President Dwight D. Eisenhower. The Eisenhower matrix helps people or groups categorize duties or tasks into 4 quadrants based mostly on their urgency and significance. The aim is to make sure that time and assets are allotted to duties that align with long-term aims whereas avoiding distractions and pointless stress from duties that don’t add worth.

RICE Scoring Mannequin

RICE is an acronym for the 4 elements used to attain and prioritize initiatives. Attain, which is how many individuals will likely be impacted by the venture or function inside a sure timeframe; affect, the potential profit or worth the venture will ship if it’s profitable; confidence, how sure the venture will obtain the specified affect; and energy, the period of time and assets required to finish the venture. The RICE rating is calculated by multiplying attain, affect and confidence and dividing that by effort.

MoSCoW Methodology

MoSCoW stands for should have, ought to have, might have and received’t have. “Should-have” is important for fulfillment and might’t be omitted. “Ought to have” is vital however not important for the venture’s fast success. “Might have” are nice-to-have options, not important for the venture however useful. “Gained’t have” are options or tasks that won’t be thought-about for the time being. Consider every venture or function and categorize it into one of many 4 teams. Prioritize the must-have tasks first, adopted by the ought to have and so forth.

Influence vs. Effort Matrix

The affect versus effort matrix is split into 4 quadrants, which categorize duties based mostly on their degree of affect (excessive or low) and energy (excessive or low). This helps groups determine the place to allocate their time and assets most successfully.

Value-Profit Evaluation

This mannequin includes evaluating the entire anticipated prices of a venture towards its whole anticipated advantages. The aim with a cost-benefit evaluation is to make sure that the advantages outweigh the prices. A easy method is to assign financial values to prices and advantages and calculate the ratio of advantages to prices.

Associated: Free Value-Profit Evaluation Template

Danger vs. Reward Matrix

This evaluated tasks based mostly on their potential return and the related dangers. The aim is to steadiness excessive rewards with acceptable ranges of threat. This usually includes scoring tasks based mostly on the estimated reward, reminiscent of income potential, affect, and so forth., and threat, reminiscent of technical challenges, market uncertainty, and so forth

ICE Scoring Mannequin

This mannequin relies on three key elements: affect, confidence and energy, and is commonly utilized in product administration, however could be utilized to any context the place prioritization is critical. ICE stands for affect, how a lot the venture will have an effect on the audience or enterprise objectives; confidence, how sure it’s that the venture will obtain the specified affect; and energy, the period of time, assets or power required to finish the venture. The ICE method is affect multiplied by confidence divided by effort equals the ICE rating.

Boston Consulting Group (BCG) Matrix

Also called the growth-share matrix, the BCG matrix is a strategic software companies use to judge the relative efficiency of their product portfolio. It does this by categorizing merchandise or enterprise items based mostly on their market progress price and market share. The matrix divides merchandise into 4 classes: stars, excessive market share in a fast-growing trade; money cows, excessive market share in a slow-growing trade; query marks or downside baby, low market share in a fast-growing trade; and canines, low market share in a slow-growing trade.

These are mapped on a matrix with an X-axis representing the market share from low to excessive and a Y-axis representing market progress from low to excessive.

How ProjectManager Helps With Venture Portfolio Administration

Venture prioritization scoring fashions are nice when making choices. They’re not going to assist implement these choices, schedule work, allocate assets and monitor progress. For that, one should have venture administration software program. Nonetheless, not each venture administration software program can deal with a number of tasks. ProjectManager is award-winning venture and portfolio administration software program with strong roadmaps to watch portfolio efficiency with useful resource administration, time monitoring and activity administration options. However that’s not all.

Actual-Time Venture Portfolio Administration Dashboards

Roadmaps provide an outline of all of the tasks in a portfolio or program on a Gantt chart. However when a portfolio supervisor or PMO desires an immediate standing report back to get an outline of all these tasks, they want a dashboard. Our portfolio dashboards seize reside knowledge and show key efficiency indicators (KPIs) reminiscent of time, value, workload and extra on easy-to-read graphs and charts. That knowledge is obtainable each time one toggles over to the dashboard and it’s delivered in actual time to make extra insightful choices.

Venture Portfolio Administration Stories

For extra particulars and to maintain stakeholders knowledgeable, use our customizable venture portfolio experiences. These experiences could be filtered to get into the weeds for portfolio managers and PMOs to point out standing, duties, timelines, spotlight prospects, precedence and extra. They will also be filtered for a extra normal overview to maintain stakeholders up to date on progress. There are additionally experiences on variance, timesheets, workload and extra.

Associated Venture Portfolio Administration Content material

Venture prioritization scoring fashions are solely a part of the bigger topic of venture portfolio administration. For these trying to learn extra concerning the subject, beneath are a handful of hyperlinks that can take readers to the newer posts we’ve printed on portfolio administration.

ProjectManager is on-line software program that connects groups whether or not they’re within the workplace, out within the area or wherever on the planet. They’ll share recordsdata, remark on the activity degree and keep up to date with electronic mail and in-app notifications. Be part of groups at Avis, Nestle and Siemens who use our software program to ship profitable tasks. Get began with ProjectManager right now without cost.