President Donald Trump has not minced phrases about his plan to crack down on unlawful immigration, and employers are taking discover. The administration has begun office raids and stakeholders predict a rise in audits of Type I-9s, the paperwork used to confirm whether or not an worker is eligible to work within the U.S.

Within the days following Trump’s inauguration, nonetheless, voices within the immigration compliance group have been more and more sounding an alarm a few vulnerability of which many employers could also be unaware: their Type I-9 distributors.

Type I-9 goes on-line

Type I-9 compliance entails a number of variables, considered one of which is how the shape is crammed out. Each employers and staff should full sure sections of the shape. Historically, an employer consultant sits down with a brand new rent in individual to gather and evaluate the worker’s paperwork that set up id and employment authorization, which can embrace some mixture of a authorities ID, a passport, a inexperienced card or related objects.

However some features of the method have turn into extra electronically pushed lately, thanks partially to the COVID-19 pandemic. In 2020, U.S. Immigration and Customs Enforcement quickly permitted employers to evaluate authorization paperwork remotely. ICE then made distant authorization a everlasting choice for E-Confirm individuals in good standing in 2023.

Digital options that assist with Type I-9 completion and recordkeeping had additionally turn into more and more frequent effectively earlier than the pandemic, in keeping with David Adams, account government at background verify supplier SafestHires, which doesn’t have its personal Type I-9 product. These instruments, supplied by HR data techniques distributors, legislation companies and different third events, are offered on the premise of streamlining what is usually a time- and resource-intensive course of for employers.

Adams and others who spoke to HR Dive mentioned they’re involved after having seen a number of platforms produce digital I-9s that don’t adjust to federal rules — opening the potential for infractions that the Trump administration is more likely to uncover.

An exterior view of U.S. Immigration and Customs Enforcement company headquarters on July 6, 2018, in Washington, D.C. ICE has beforehand issued tens of millions in fines over noncompliant digital Type I-9 techniques.

Alex Wong / Employees by way of Getty Pictures

A two-part drawback

There are two foremost areas of concern for HR groups, Adams mentioned. The primary is that Type I-9 vendor software program could prepopulate sure sections of the Type I-9, akin to an worker’s biographical data.

Per joint steering by ICE and the U.S. Division of Justice, employers utilizing Type I-9 software program packages could not prepopulate I-9s with worker data that has been gathered by way of exterior sources akin to the worker’s job software. Employers additionally could not full an I-9 on an worker’s behalf until they’re serving to the worker full Part 1 of the shape — the place staff enter their data and attestation — as a preparer or translator.

The second space of concern is paper Type I-9s which have been affixed with an worker’s digital signature utilizing a software program program. The issue is that using an digital signature necessitates compliance with a number of U.S. Division of Homeland Safety requirements separate from those who apply to paper I-9s, and this might put employers successfully out of compliance.

Whereas it’s unlikely I-9 distributors have purposefully launched noncompliant merchandise, Adams mentioned, it isn’t sufficient to belief a vendor’s insistence {that a} product is compliant. HR groups, he mentioned, should ask the proper questions and can’t assume compliance; “it’s worthwhile to have a look at your system.”

In reality, the extra compliance measures required for digital varieties are myriad. For one, DHS rules require that employers hold “audit trails” of digital I-9s, that are data displaying what actions have been taken with respect to a particular kind, mentioned Chris Thomas, companion at Holland & Hart. And even when a vendor does hold an audit path, the standard of these trails might not be adequate to fulfill DHS requirements, he added.

DHS rules additionally state that employers should implement an digital data safety program that:

- Ensures solely approved personnel have entry to digital data.

- Offers for backup and restoration of data to guard towards data loss, akin to throughout energy interruptions.

- Ensures that staff are educated to attenuate the danger of unauthorized or unintended alteration or erasure of digital data.

- Be sure that each time the digital document is created, accomplished, up to date, modified, altered or corrected, a safe and everlasting document is created that establishes the date of entry, the id of the person who accessed the digital document and the actual motion taken.

The worker’s attestation may create compliance considerations. DHS requires digital techniques used to seize an attestation to incorporate a way that may present the worker has signed and browse the attestation. The signature have to be affixed on the time of the transaction and the system should create and protect a document verifying the signer’s id.

However Thomas mentioned a number of digital I-9 techniques he has reviewed don’t embrace such an attestation. That requirement may very well be fulfilled, partially, with a small field that an worker can verify to affirm that they’ve learn the attestation and entered their signature. “The legal guidelines are clear that in the event that they don’t have that, then there’s no I-9 in any respect within the eyes of DHS,” Thomas added. “Many distributors should not have that attestation.”

Federal legislation enforcement businesses have beforehand taken motion towards employers utilizing noncompliant digital Type I-9 techniques. Adams famous that in 2010, ICE fined retailer Abercrombie & Fitch greater than $1 million over technology-related deficiencies within the firm’s digital Type I-9 verification system.

Adams mentioned related enforcement by the Trump administration may very well be pricey for employers. On Jan. 2, DHS detailed civil financial penalty changes for inflation during which the penalty for Type I-9 paperwork violations elevated from a most of $2,789 per violation to $2,861 per violation.

“If it’s not compliant, you’re going to pay a lot cash,” Adams mentioned.

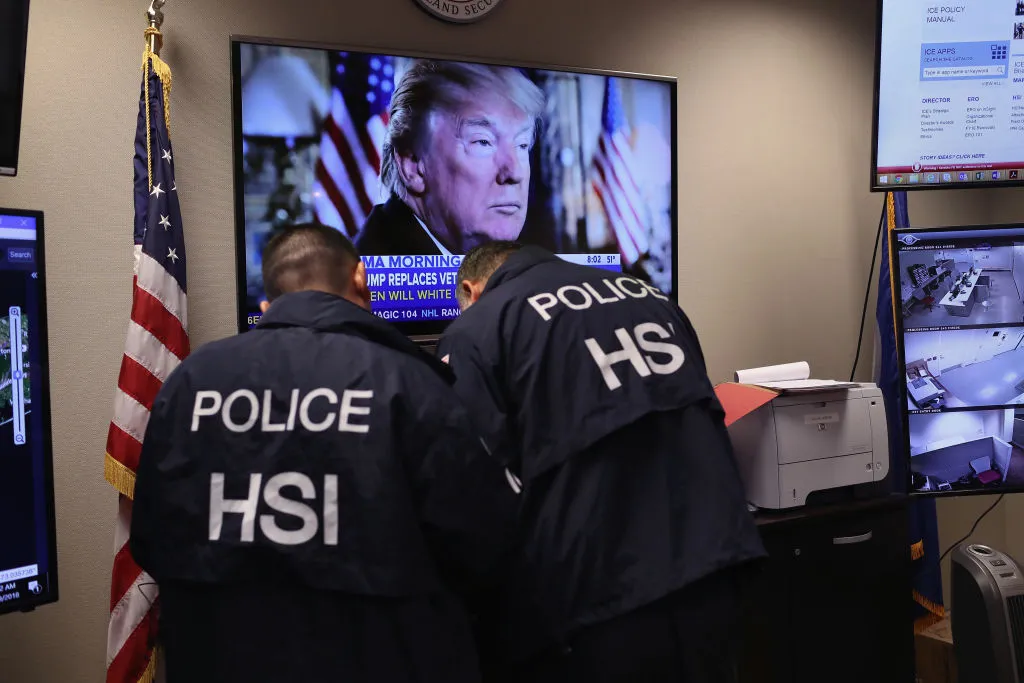

Homeland Safety Investigations ICE brokers work in a management heart throughout an operation on March 29, 2018, in Central Islip, N.Y. Attorneys who spoke to HR Dive largely agreed that digital Type I-9 compliance is a priority below President Donald Trump.

John Moore by way of Getty Pictures

‘Everyone’s within the crosshairs right here’

Administration-side attorneys who spoke to HR Dive largely agreed that digital Type I-9 compliance is a priority for employers below Trump. Thomas mentioned he has spoken with brokers at ICE who’ve confirmed the company’s intention to pursue enforcement actions towards employers whose digital Type I-9 distributors are out of compliance.

ICE didn’t reply to a number of requests for touch upon its plans for digital Type I-9 compliance enforcement.

The primary day of Trump’s second time period alone noticed a variety of government orders aimed toward decreasing unlawful immigration, together with an order declaring an emergency on the U.S.-Mexico border and one other aimed toward stopping mass migration and resettlement. A separate order, “Defending the American Individuals In opposition to Invasion,” directs DHS to “take all applicable motion to considerably improve the variety of brokers and officers accessible to carry out the duties of immigration officers.”

The latter of this stuff could also be significantly essential given the restricted variety of brokers available to conduct I-9 audits amongst ICE’s 30 regional Homeland Safety Investigations Particular Agent in Cost places of work, mentioned Thomas. He famous that the company has labored with on-site contractors to hurry up the tempo of large-scale audits and will institute quotas to that impact.

“They are going to do every part to interrupt the employment magnet within the U.S.,” Thomas mentioned. “Everyone’s within the crosshairs right here.”

The chance of an I-9 audit discovering errors exists even when an worker is allowed to work within the U.S., mentioned Doug Kauffman, companion at Balch & Bingham, as a result of a system can nonetheless be deemed noncompliant.

Employers want to start having conversations with Type I-9 distributors now, earlier than potential enforcement motion takes place, attorneys instructed HR Dive.

brazzo by way of Getty Pictures

What to do now

HR groups should take the initiative and guarantee their distributors are conscious of DHS rules, Kauffman mentioned; “ICE is just not going to allow you to off the hook.”

It additionally could also be value going a step additional: “Employers mustn’t assume that their software program resolution is compliant,” mentioned Eileen Lohmann, senior affiliate at legislation agency BAL. “It truly is essential to independently vet each digital resolution they’re utilizing to verify it complies with the rules. It’s at all times going to be the employer who’s responsible for any errors on their Type I-9.”

In serving to employers select between totally different I-9 vendor proposals, Kauffman mentioned he’s “at all times wanting on the regs each time,” as that is what ICE will give attention to when evaluating employers. He mentioned he additionally focuses on what distributors will do when their purchasers are audited by ICE, and what their processes and procedures are for guaranteeing purchasers have entry to the supplies ICE will ask for — together with audit trails — inside three enterprise days.

“If we’re not capable of present it to ICE, it doesn’t do us a lot good,” Kauffman mentioned.

Lohmann equally mentioned employers ought to contemplate a vendor’s course of within the occasion of an audit. She mentioned she additionally recommends that employers proactively do an inner I-9 audit to get a way of what ICE would possibly discover. This might contain wanting by way of a subset of I-9s with or with out the help of exterior counsel. “Even a smaller evaluate can permit an employer to course appropriate and scale back their threat of publicity going ahead,” Lohmann mentioned.