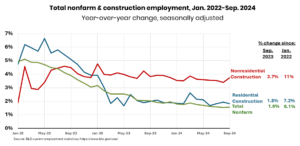

Building employment, seasonally adjusted, totaled 8,303,000 in September, a achieve of 25,000 from August and 238,000 (3 p.c) year-over-year (y/y), in accordance with an Related Normal Contractors’ (AGC) evaluation of information the U.S. Bureau of Labor Statistics (BLS). The y/y development price outpaced the 1.6 p.c enhance in complete nonfarm payroll employment. Residential development employment rose by 7,800 in September (2,000 at residential constructing corporations and 5,800 at specialty contractors) and 60,500 (1.8 p.c) y/y. Nonresidential development employment elevated by 17,900 for the month (3,800 at heavy and civil engineering development corporations and 17,000 at specialty commerce contractors, offsetting a decline of two,000 at constructing corporations) and 177,800 (3.7 p.c) y/y. Seasonally adjusted common hourly earnings for manufacturing and non-supervisory workers rose 3.9 p.c y/y for the full personal sector and 4 p.c for development (i.e., most craft and workplace employees). The {industry} unemployment price in September, not seasonally adjusted, was 3.7 p.c, which was decrease than the all-industry price (3.9 p.c, not seasonally adjusted) for the fourth consecutive month. The variety of unemployed jobseekers with development expertise totaled 403,000, not seasonally adjusted, a rise of 11,000 (2.8 p.c) y/y.

Building employment, seasonally adjusted, totaled 8,303,000 in September, a achieve of 25,000 from August and 238,000 (3 p.c) year-over-year (y/y), in accordance with an Related Normal Contractors’ (AGC) evaluation of information the U.S. Bureau of Labor Statistics (BLS). The y/y development price outpaced the 1.6 p.c enhance in complete nonfarm payroll employment. Residential development employment rose by 7,800 in September (2,000 at residential constructing corporations and 5,800 at specialty contractors) and 60,500 (1.8 p.c) y/y. Nonresidential development employment elevated by 17,900 for the month (3,800 at heavy and civil engineering development corporations and 17,000 at specialty commerce contractors, offsetting a decline of two,000 at constructing corporations) and 177,800 (3.7 p.c) y/y. Seasonally adjusted common hourly earnings for manufacturing and non-supervisory workers rose 3.9 p.c y/y for the full personal sector and 4 p.c for development (i.e., most craft and workplace employees). The {industry} unemployment price in September, not seasonally adjusted, was 3.7 p.c, which was decrease than the all-industry price (3.9 p.c, not seasonally adjusted) for the fourth consecutive month. The variety of unemployed jobseekers with development expertise totaled 403,000, not seasonally adjusted, a rise of 11,000 (2.8 p.c) y/y.

Building spending (not adjusted for inflation) totaled $2.13 trillion in August at a seasonally adjusted annual price, down 0.1 p.c from the downwardly revised July price however up 4.1 p.c y/y, the Census Bureau reported on Tuesday. Non-public nonresidential spending dipped 0.1 p.c for the month. The most important subsegment, manufacturing, rose 0.2 p.c; energy development slumped 0.7 p.c; industrial slid 0.4 p.c (comprising warehouse, up 0.5 p.c; retail, down 2.3 p.c; and farm, up 2 p.c); and workplace rose 0.2 p.c (with knowledge facilities up 1 p.c and different “places of work” down 0.2 p.c). Non-public residential spending declined 0.3 p.c (single-family, down 1.5 p.c; multifamily, down 0.4 p.c; and enhancements, up 1 p.c). Public development climbed 0.3 p.c, with freeway and road up 1.1 p.c; training flat; transportation down 0.2 p.c; and sewage and waste disposal down 0.5 p.c.

There have been 370,000 job openings in development, seasonally adjusted, on the finish of August, a drop of 16,000 (-4.1 p.c) y/y, BLS reported on Tuesday. Hires for the complete month totaled 338,000, a drop of 36,000 (-9.6 p.c). Layoffs and discharges totaled 164,000 or 2 p.c of workers, the second-lowest August price within the 24-year historical past of the information. The truth that end-of-month openings exceeded hires for the complete month suggests employers needed to rent greater than twice as many employees as they have been capable of; the low layoff price signifies corporations wish to hold onto employees.