One other incomes season is over. The winners? Most of our shares. Twenty-three out of 33 portfolio names delivered third-quarter stories have been deemed good or nice by the Investing Membership, thanks partly to a still-strong client and largely to the huge construct out of all issues AI. Working example: Within the S & P 500, 86% of expertise corporations beat gross sales estimates for the third quarter, in response to FactSet information. That was adopted by healthcare (79%) and actual property (74%). Communication providers led all sectors for bottom-line beats, with 95%, adopted by expertise, at 86%. Two large strikes to notice. We initiated a place in Goldman Sachs after the monetary title reported third-quarter outcomes — we clearly appreciated what we noticed on the discharge and heard from administration — so it is not included on this report. Additionally excluded is Superior Micro Units , which we exited Dec. 31 after the chipmaker reported lackluster outcomes and gave little cause to keep it up into the brand new yr. As all the time, we’re wrapping up the season with a assessment of outcomes for all Membership holdings. These quarterly report playing cards should not the end-all, be-all for evaluation. Nevertheless, we consider inventory costs in the end comply with the underlying enterprise fundamentals of corporations and having an thought of which corporations did properly and which did not might help with shopping for and promoting choices. Just like prior quarters, we grouped firm outcomes into certainly one of 4 classes. The businesses in every class are listed in alphabetical order. The Nice The Good The Not So Unhealthy The Ugly The Nice Alphabet “Listening to the post-earnings convention name made one factor abundantly clear: Synthetic intelligence is being woven into each side of this firm and, in flip, driving extra engagement from each customers and enterprise prospects alike. It is not simply income that AI helps to develop, it is also serving to the corporate turn out to be extra environment friendly than ever.” — Oct. 29 after the bell Amazon “[The company] reported a a lot better-than-expected third quarter Thursday, with robust development throughout on-line gross sales, its cloud enterprise and promoting. Margin initiatives result in hovering income. Moreover, the fourth-quarter forecast was precisely what was wanted to maintain traders completely satisfied.” — Oct. 31 after the bell (Amazon is a core holding within the Membership’s portfolio; certainly one of 12 shares with this designation.) Broadcom “The headline numbers for the August-to-October quarter might have been blended, however make no mistake, this was a really robust report. You would not perceive simply how robust, although, until you listened to the earnings name. It’s the newest instance to help Jim Cramer’s long-held investing precept that traders want to attend for the decision earlier than making a post-earnings commerce.” — Dec. 12 after the bell (We exited Superior Micro Units on Dec. 31 as a result of corporations need customized AI chips from Broadcom and others if they can not get Nvidia.) BlackRock “The agency posted third-quarter earnings that crushed analysts’ expectations, but once more. Administration additionally introduced that property beneath administration reached one other document excessive, an unimaginable $11.5 trillion, on surging inflows because the inventory market rallied.” — Oct. 11 earlier than the bell (The Membership known as up the world’s largest asset supervisor from the Bullpen and began a place on Oct. 16 .) Costco “Costco shares should not low-cost by conventional requirements, buying and selling at round 54 occasions next-12-months EPS estimates. The lofty valuation, nonetheless, hasn’t stopped the inventory’s monstrous rise through the years. The inventory is deserving of its hefty premium because of the firm’s share positive aspects and dependability with a subscription mannequin.” — Dec. 12 after the bell (Costco is a core Membership holding.) Disney “It was an amazing quarter. Gross sales and earnings beat. The corporate generated robust money circulate. And maybe most significantly for traders, its direct-to-consumer streaming unit’s profitability was properly forward of the consensus estimate. And the nice run ought to proceed, with administration forecasting earnings development acceleration over the subsequent couple of years.” — Nov. 14 earlier than the bell Meta Platforms “[The company] delivered one heck of a powerful third quarter and a present quarter income information above expectations. … Fewer-than-expected day by day energetic customers within the quarter and bump greater in full-year capital expenditures steerage [were not concerning],” — Oct. 30 after the bell (Meta is a core Membership holding .) Morgan Stanley “This was as clear 1 / 4 as anybody might have requested for. Morgan Stanley outpaced expectations in nearly each side of every working division and put up very robust quarterly outcomes by way of firmwide key efficiency indicators.” — Oct. 16 earlier than the bell (Regardless of the robust quarter, the Membership offered half of its Morgan Stanley place on Dec. 19 and initiated a place in Goldman Sachs. Within the commerce alert, we wrote, “We plan to make use of our remaining Morgan Stanley shares as a supply of funds to scale deeper into Goldman Sachs .”) Nvidia “Nvidia reported a improbable quarter … even when steerage for the present quarter got here up a bit in need of the loftiest expectations. … It is onerous to complain a few beat-and-raise quarter simply because the beat and lift wasn’t as large as some craved.” — Nov. 20 after the bell (Nvidia is certainly one of two “personal it, do not commerce it” shares within the portfolio. Apple is the opposite one . Each are among the many Membership’s core holdings) Wells Fargo “[The company] missed expectations on third-quarter income. Buyers centered as an alternative on the financial institution working leaner and producing better-than-expected profitability. … We just like the effectivity positive aspects on the financial institution; the progress being made to get the Federal Reserve-imposed asset cap lifted; and the optimistic outlook for the economic system and inflation.” — Oct. 11 earlier than the bell (Wells Fargo is a core Membership holding .) The Good Apple “[The company] delivered 1 / 4 that may solely be described as significantly better than feared. It wasn’t good, however it was fairly darn good. … We’re as soon as once more reminded why it does not pay to attempt to recreation Apple’s quarterly launch. For all of the fearmongering now we have needed to cope with over the previous few weeks about simply how horrendous this print was going to be, it ended up being a September quarter gross sales document for the world’s biggest client expertise firm.” — Oct. 31 after the bell Abbott Laboratories “In its third quarter, Abbott Labs demonstrated why we needed to stay with the inventory within the face of authorized battles that emerged earlier this yr and spooked traders. … [The company] upped its earnings steerage for the third straight quarter.” — Oct. 16 earlier than the bell Bristol-Myers Squibb “Third-quarter earnings and income that blew previous Wall Road’s expectations due to its blockbuster blood thinner Eliquis and a portfolio of medicine it expects to ship long-term development.” — Oct. 31 earlier than the bell (The Membership known as Bristol-Myers up from the Bullpen and began a place on Nov. 25 , inspired by the corporate’s FDA-approved drug Cobenfy, the primary novel therapy for schizophrenia in over 30 years.) CrowdStrike “CrowdStrike CEO George Kurtz famous on the [fiscal 2025 third quarter] earnings launch that the corporate has realized a gross retention charge of over 97%, an essential issue given investor considerations about prospects leaving the platform following a botched software program replace again in July that brought on a world IT outage. Because the glitch, Kurtz and his workforce have placed on a grasp class in addressing the corporate’s misstep — and because the fiscal third-quarter outcomes present, it seems to be resonating with prospects.” — Nov. 26 after the bell DuPont “DuPont’s efficiency on profitability metrics shined, with the better-than-expected working EBITDA and earnings outcomes for the quarter compounded by a rise to administration’s full-year outlook on each metrics. Revenue margin efficiency was additionally robust, as was money circulate technology, with transaction-adjusted free money circulate conversion of 130% — an indication of wholesome earnings.” — Nov. 5 earlier than the bell Danaher “Buyers [on the earnings release] questioned the sustainability and magnitude of bioprocessing enhancements in 2025. Wall Road’s response [then] doesn’t mirror the strides Danaher made in that essential end-market, which is contained within the firm’s biotechnology section.” — Oct. 22 earlier than the bell (Danaher is a core Membership holding .) House Depot “Excessive rates of interest and financial uncertainty nonetheless weigh on House Depot. However similar retailer gross sales — a key metric within the retail area that seeks to regulate gross sales outcomes for brand new retailer opening or closings — whereas down from a yr in the past, did present enchancment within the U.S. and globally. The corporate elevating its steerage is one more reason to remain optimistic.” — Nov. 12 earlier than the bell (House Depot is a core Membership holding .) Linde “It wasn’t the standard beat-and-raise quarter that Linde has turn out to be identified for through the years. Nevertheless, its income rising quicker than gross sales exhibits how adept the corporate is at navigating powerful financial circumstances. As soon as financial exercise picks up – maybe from decrease rates of interest across the globe – and volumes develop once more, we count on Linde will likely be again to its regular beat-and-raise cadence.” — Oct. 31 earlier than the bell (Linde is a core Membership holding .) Microsoft “[Despite] optimistic developments and improvements, income steerage for subsequent quarter fell a contact in need of expectations. That is a no-no on this market that wants beats and raises to ship shares greater, particularly for a inventory the place there may be nonetheless some investor frustration on whether or not these large AI bets will repay.” — Oct. 30 after the bell Nextracker “Arguably the perfect a part of Nextracker’s report was the rise in its backlog — much more so than the income and earnings beats. Why? As a result of questions on Nextracker’s backlog overshadowed stronger-than-expected headline leads to August.” — Oct. 30 after the bell Palo Alto Networks “The cybersecurity firm delivered robust fiscal 2025 first-quarter outcomes, beating estimates on principally each line. It additionally raised full-year steerage throughout a number of key metrics. … The cybersecurity firm delivered robust fiscal 2025 first-quarter outcomes, beating estimates on principally each line. It additionally raised full-year steerage throughout a number of key metrics.” — Nov. 20 after the bell Salesforce “Wall Road is prepared to look previous Salesforce’s slight miss on adjusted EPS due to the upbeat income efficiency. Buyers know Salesforce has turn out to be disciplined on margins, however what the market actually needs to see subsequent to take the inventory greater is healthier topline development. The quarterly outcomes and outlook demonstrated that the corporate’s fundamentals have remained resilient with none contribution from some of the thrilling product launches in its historical past: Agentforce.” — Dec. 12 after the bell TJX Firms “Whereas steerage was a bit under expectations, it was not overly regarding given the off-price retailer’s proclivity to under-promise and over-deliver. … We’re prepared to look previous the sunshine outlook as a result of TJX’s historical past of conservative guides and due to the Q3 energy and the alternatives administration sees for additional development.” — Nov. 20 earlier than the bell (TJX is a core Membership holding .) The Not so Unhealthy Coterra Vitality “Although gross sales and discretionary money circulate outcomes got here up brief, administration’s strict adherence to price self-discipline allowed for beats the place it counts: on earnings and free money circulate technology.” — Oct. 31 after the bell Eaton “We did not see something in Eaton’s report or administration’s outlook for the rest of the yr and into 2025 that causes us to rethink our funding. … A significant driver for Eaton, central to our funding thesis, is promoting merchandise wanted to energy the build-out of information facilities to deal with synthetic intelligence workloads.” — Oct. 31 earlier than the bell (Eaton is a core Membership holding .) Finest Purchase “Finest Purchase’s quarter got here up in need of expectations, with the misses compounded by downward revisions to administration’s outlook for the rest of the yr. We weren’t shocked.” — Nov. 26 earlier than the bell (In the course of the December Month-to-month assembly, Jim mentioned AI private pc gross sales and decrease mortgage charges have been issues he thought would occur and enhance the inventory. “Sadly, each have been a bust up to now, and we’re unsure what 2025 has in retailer,” he mentioned.) Dover “[The company] reported weaker-than-expected third-quarter outcomes. … We’re not involved: The corporate’s latest asset gross sales are possible inflicting some confusion in regards to the numbers. … The explanations we personal the inventory, notably its synthetic intelligence publicity, are nonetheless totally intact.” — Oct. 24 earlier than the bell GE Healthcare “Outcomes have been blended, however it comes as no shock that the quarter was negatively impacted by weak point in China. Excluding enterprise on this planet’s second-largest economic system, reported ex-China gross sales have been up about 5%, with ex-China natural order development up 4% versus the prior yr.” — Oct. 30 earlier than the bell Starbucks “Returning quickly to a Starbucks close to you: Ceramic mugs, Sharpies on cups and the condiment bar so as to add your personal cream and sugar. … [That’s according to Brian Niccol] … on his first earnings name since taking up as CEO of the struggling espresso large on Sept. 9. Starbucks [on Oct. 23] preannounced an unsightly set of fiscal 2024 fourth-quarter outcomes and suspended 2025 steerage. So, the primary occasion [earnings night] was what the previous Chipotle boss needed to say.” — Oct. 30 after the bell Stanley Black & Decker Whereas the numbers have been disappointing, the corporate’s turnaround continues to plan. … Gross sales missed in each key working segments, Instruments & Outside and Industrial, [but] we’re extra centered on how profitability in every nonetheless managed to outpace expectations.” — Oct. 29 earlier than the bell Constellation Manufacturers Modelo and Corona brewer Constellation Manufacturers is a story of two companies. Certainly one of them — beer — is stealing market share left and proper. The opposite — wine and spirits — is an anchor on the inventory. Nothing within the firm’s fiscal 2025 second-quarter outcomes on Thursday modified that narrative. However the subsequent two quarters may. — Oct. 3 earlier than the bell (We added some Constellation shares on Dec. 31 after calling it out in a Friday display screen of low-cost shares to purchase .) The Ugly Honeywell “[The] industrial large reported blended third-quarter outcomes compounded by a blended outlook. … Honeywell has confirmed to be a irritating holding.” — Oct. 24 earlier than the bell (In a commentary on Dec. 16 , we wrote, “Honeywell has responded to activist hedge fund Elliott Funding Administration’s calls to interrupt up the economic conglomerate. Jim Cramer says it is excellent news.”) Eli Lilly “The diabetes-and-obesity drug large posted disappointing third-quarter outcomes and lowered its full-year gross sales steerage. The report was messy, however it does not dim Eli Lilly’s brilliant multiyear outlook.” — Oct. 30 earlier than the bell (Lilly is a core Membership holding . Jim Cramer has since known as the drugmaker the “Nvidia of pharma.” ) — Jeff Marks , director of portfolio evaluation for the CNBC Investing Membership, contributed to this report. (See right here for a full checklist of the shares in Jim Cramer’s Charitable Belief.) As a subscriber to the CNBC Investing Membership with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a inventory in his charitable belief’s portfolio. If Jim has talked a few inventory on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

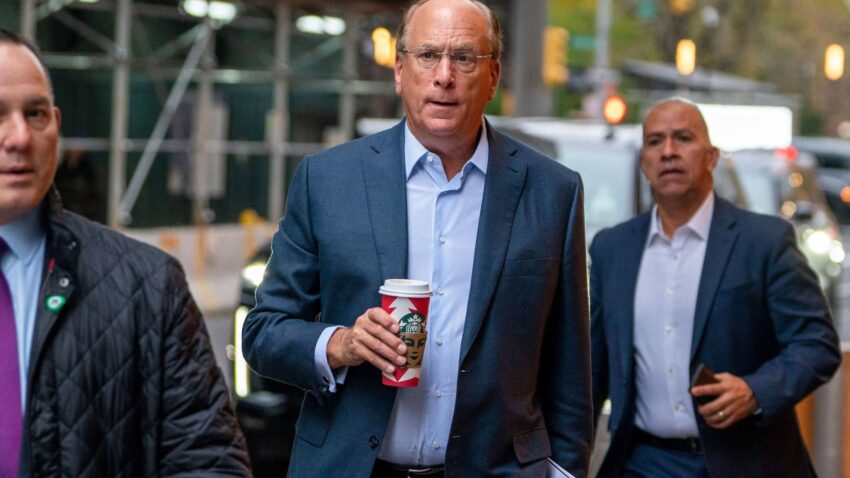

Larry Fink, Chairman and C.E.O. of BlackRock arrives on the DealBook Summit in New York Metropolis, November 30, 2022.

David Dee Delgado | Reuters

One other incomes season is over. The winners? Most of our shares. Twenty-three out of 33 portfolio names delivered third-quarter stories have been deemed good or nice by the Investing Membership, thanks partly to a still-strong client and largely to the huge construct out of all issues AI.