You should have seen that some months really feel longer than others. It’s not simply your creativeness. Whereas most months have 4 full weeks, some months have 5.

In 2025, there might be 4 months with 5 weeks: January, Could, August, and October, and it’ll affect all stakeholders, from workers to companies. Dive into this text to find how every stakeholder is impacted and methods to plan for that.

Why do some months have 5 weeks?

First up, with the intention to perceive why some months have 5 weeks, it is advisable take a better have a look at how weeks and months intersect. Most months have 30 or 31 days, aside from February, which has 28 (or 29 in a bissextile year). However 28, 30, and 31 don’t divide evenly by 7. Which means every month doesn’t align completely with a 4-week timeframe.

The “further” days accumulate till a month finally ends up with elements of 5 totally different weeks in it. On common, this occurs about 4 occasions per yr. A month could have 5 weeks anytime it begins early in a single week and ends later within the fifth week. As an example, beginning on a Friday and ending on a Sunday.

Observe: In the event you’d like to know the idea of a bissextile year, I’ve outlined it in one other article known as What number of work days there are in a yr.

Months with 5 weeks in 2025

In 2024, the months with 5 weeks had been March, Could, August, November. Now, for 2025, the months with 5 weeks would be the following:

Let’s have a look at precisely when it will happen in 2025.

In 2025, the next months could have 5 weeks:

1. January (begins Wednesday, 1/1, ends Friday, 1/31)

2. Could (begins Thursday, 5/1, ends Saturday, 5/31)

3. August (begins Friday 8/1, ends Sunday 8/31)

4. October (begins Wednesday 10/1, ends Friday 10/31)

How does a 5-week month affect an employer?

5-week months have an effect on work schedules, capability planning, and budgets in a fiscal yr, because it shifts when the common payday falls in a month. As an employer, it is advisable issue within the following:

1. Payroll and budgeting

Probably the most rapid impacts of a five-week month is on payroll and your month-to-month pay schedule.

You probably have hourly workers, you’ll pay them for an additional week of labor in these months. Even when your staff’s hours don’t change, that further paycheck interval can add up, particularly if in case you have a big hourly workforce. For workers, the month-to-month earnings received’t essentially include a change of their paychecks, however it’s nonetheless an additional pay interval it is advisable account for in your funds as a enterprise.

That’s why it is advisable funds proactively and think about these 4 five-week months whenever you’re creating your annual funds. Allocate further funds for payroll in January, Could, August and October. This manner, you’ll keep away from a last-minute disaster in money movement administration.

Associated sources on payroll administration and monitoring:

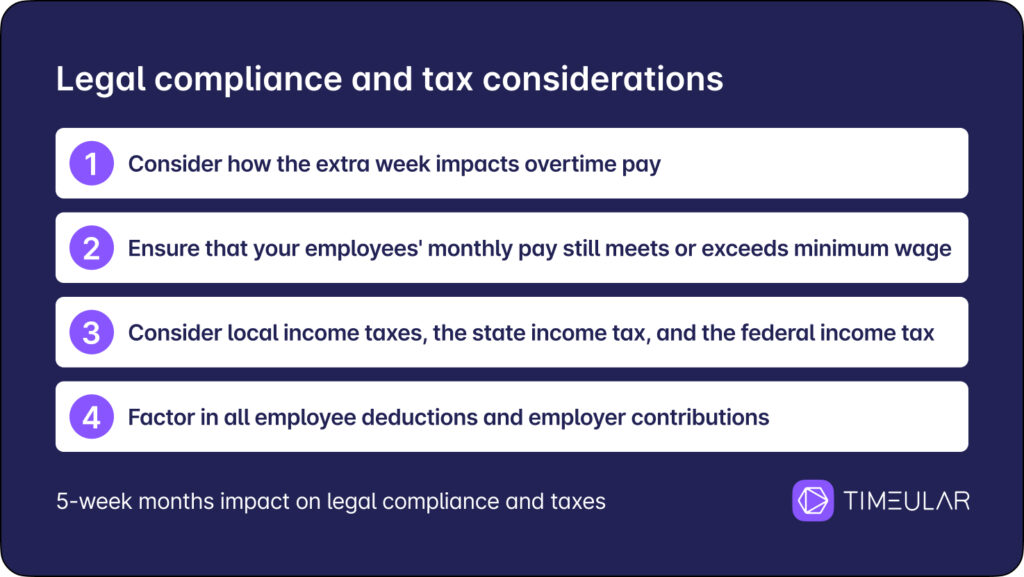

2. Authorized compliance and tax concerns

When you’re adjusting your funds for five-week months, it’s additionally vital to make sure you’re staying compliant with all related labor legal guidelines and tax laws. That is particularly vital if in case you have hourly workers who are actually working (and incomes) extra in these months. As a way to keep compliant, account for the next:

Additional time pay

First, contemplate how the additional week impacts extra time pay. On this case, the Truthful Labor Requirements Act (FLSA) asks that employers pay half and one time of normal charges of pay in a 40-hour week. With an additional week within the month, some workers could find yourself working extra extra time than typical. Ensure you’re correctly monitoring and compensating for these hours.

Minimal wage

An extended month additionally means extra hours labored in whole. Be certain that your workers’ month-to-month compensation nonetheless meets or exceeds minimal wage necessities, even with the extra week.

Payroll taxes

From a tax perspective, five-week months imply further paychecks to account for. Typically, this impacts your tax deposits, as it is advisable contemplate native earnings taxes, a state earnings tax, and the federal earnings tax. Your accountant or payroll supplier ought to be capable to make clear what the Federal Insurance coverage Contributions Act (FICA) requires from employers and the way a lot taxes you’ll must think about.

Advantages administration

In the event you provide advantages like medical health insurance or retirement plans, contemplate how a second or third paycheck impacts your month-to-month money movement. Consider all worker deductions and employer contributions and probably profit administration processes for these months.

Mission planning and scheduling impacts

Past the monetary and authorized concerns, five-week months additionally affect your venture planning and scheduling. In the event you’ve scoped out a venture primarily based on a normal four-week month, that further week might be a detour. It is advisable to recalculate your plan, and these extra weeks can be utilized for the next:

- Tackle an additional venture or shopper

- Deal with a strategic initiative you’ve been laying aside

- Give your staff some respiratory room to good their work

- Put money into skilled improvement or staff constructing

The right way to plan for 5-week months (as an employer)

There are different implications for a enterprise, however these are a very powerful. Nonetheless, with the intention to keep on high of all these modifications, payroll schedules, capability planning, and compliance, all processes associated to those modifications have to be automated.

Right here’s what a payroll tracker may help with:

- Payroll schedules and budgeting: A timesheet app tracks worker hours robotically for payroll reviews and reveals you real-time visibility into venture budgets primarily based on the precise hours labored.

- Authorized compliance and tax concerns: The work hours tracker alerts you when workers are approaching extra time thresholds that will help you handle prices. Furthermore, it offers you the information wanted for compliance.

Such time trackers are built-in with payroll and accounting instruments.

- Mission planning and scheduling impacts: Mission time monitoring is built-in into such instruments, and even for those who might need scheduled initiatives wrongly, you obtain visibility into staff capability and utilization throughout initiatives in actual time. This manner, you’re in a position to forecast future initiatives.

Affect on workers

As an worker, you get to expertise each advantages and disadvantages. Subsequently, it is advisable plan upfront for those who get more money, for those who’ll be saving cash or directing it towards a vacation, and most significantly, hold your work-life stability in test. Listed here are among the implications you’ll have in 2025:

1. Earnings fluctuations for hourly workers

A five-week month primarily means an additional paycheck for those who’re paid weekly or month-to-month by the hour.

You’ll be working (and incomes) for an additional week in comparison with a typical month. The additional earnings in your checking account could be a good bonus. However bear in mind, there’s a further week’s common bills added to your month-to-month bills. It’s sensible to allocate it thoughtfully and never take the additional paycheck as “free cash.”

Some issues to contemplate listed below are:

- Begin constructing an emergency fund, a financial savings account for powerful occasions, or perhaps a retirement financial savings account. This manner, you guarantee monetary stability for your self and your loved ones.

- Put money into your long-term monetary targets. Be it a visit to the Island, shopping for your personal home, or another dream, these typical two paychecks have now become three paychecks, or much more could make it doable.

- Cowl upcoming giant bills along with your bonus cash. If you already know you’re renovating your own home or planning to alter your job, put the cash from the additional paycheck months apart.

2. Affect on salaried workers

In the event you’re a salaried worker, your paycheck probably received’t change in a five-week month. Nonetheless, you might really feel like working “further” days for a similar pay. This may be mentally difficult and might really feel unfair, particularly in case your workload will increase to fill the additional time. It’s vital to handle your power and keep away from burnout throughout these longer months.

One technique is to make use of the additional days for actions that profit you professionally or personally. You might:

- Deal with a venture you’ve been desirous to work on. Possibly you’ve been dreaming of beginning a weblog to share your experience or experiences. Use the additional days to brainstorm subjects, define your first few posts, and arrange your platform.

- Study a brand new ability associated to your job. Begin studying methods to deal with AI to your profit and do your job sooner than you probably did earlier than.

- Attend a convention or workshop. Search for conferences or meetups targeted in your trade or pursuits. Casual gatherings may be an effective way to attach with like-minded professionals and stage up your profession.

- Take a time off for psychological well being or private errands. This might embody issues like a nature hike, a spa remedy, a yoga class, or curling up with a great e book.

3. Advantages and deductions

You probably have advantages like medical health insurance or retirement plans via your employer, it’s vital to know how a five-week month impacts your deductions and contributions.

- In some instances, your employer could modify your deductions to unfold them out over the additional pay interval. This might barely scale back your take-home pay for that month.

- On the flip facet, for those who’re contributing to a 401(ok) or different retirement plan, the additional pay interval might imply more cash going towards your long-term financial savings (particularly in case your employer presents a match).

Make sure to evaluation how totally different payroll schedules affect your pay and discuss to your HR division if in case you have questions on how your advantages are impacted by a five-week month.

Begin your 2025 work plan

Each as an employer and an worker, it is advisable proactively modify plans and resolve in regards to the timelines of your initiatives and workloads to the brand new schedule earlier than the top of every yr.