Biweekly pay is a well-liked payroll choice, however does it work for your enterprise? With 26 paychecks a 12 months, workers take pleasure in common, predictable revenue. For employers, nevertheless, the choice to undertake biweekly pay includes extra than simply comfort.

Dive into this text to study what’s biweekly pay, the right way to calculate it, and what to consider implementing it.

Takeaways:

- Biweekly pay implies that you obtain 26 paychecks per 12 months. Meaning two month-to-month paychecks, apart from two months of the 12 months once you’ll get three.

- When deciding on the very best pay schedule, firms should assess workforce composition (hourly vs. salaried), business norms, payroll processing capability, and money stream. There’s no common “proper” alternative.

- As bi-weekly pay implies frequent paychecks, it’s finest to implement an computerized payroll tracker to streamline the method and keep away from asking your self the right way to fill out timesheets.

Biweekly pay 101

At its core, biweekly pay implies that workers obtain their paychecks each different week, sometimes on the identical day every pay interval, like each different Friday. Image a calendar with 52 weeks in a 12 months. With biweekly pay, you get a paycheck on 26 of these weeks or as soon as each two weeks. Easy sufficient, proper?

However right here’s the place it will get a bit extra advanced. Since there are often barely greater than 28 days a month, a biweekly pay schedule doesn’t all the time align completely with the calendar months.

I’ve created an instance for instance that:

Think about you receives a commission bi-weekly, each different Friday. Right here’s how a couple of months of your pay schedule may look:

- Friday, January 13: Paycheck

- Friday, January 27: Paycheck

- Friday, February 10: Paycheck

- Friday, February 24: Paycheck

- Friday, March 10: Paycheck

- Friday, March 24: Paycheck

- …and so forth.

Discover how paychecks don’t line up with the first and fifteenth of every month? That’s the character of biweekly pay. It follows a 14-day cycle moderately than the month-to-month calendar. Now, you could be questioning, “What number of paychecks do I get in a 12 months with biweekly pay?” Let’s do the maths.

- 52 weeks in a 12 months ÷ 2 = 26 paychecks per 12 months

However wait, there’s a twist! As a result of 26 pay intervals x 14 days = 364 days, which is sooner or later in need of a 365-day 12 months (and two days quick on leap years), there are two months within the 12 months the place you’ll obtain three paychecks as a substitute of two.

Methods to calculate biweekly pay

Now that you just’ve acquired the overall idea down, let’s discuss numbers. How do you truly calculate biweekly pay? I’m calculated in a different way because it will depend on the character of the way you’re paid (paid hourly or fastened wage). Let’s discover how this works for each hourly and salaried workers.

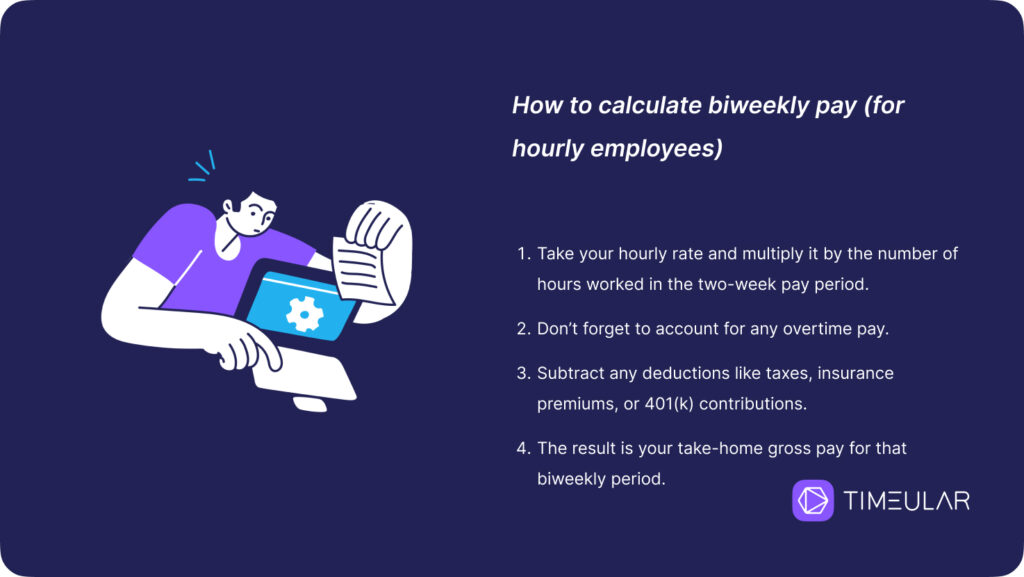

For hourly workers:

- Take your hourly fee and multiply it by the variety of hours labored within the two-week pay interval.

- Don’t neglect to account for any additional time pay.

- Subtract any deductions like taxes, insurance coverage premiums, or 401(okay) contributions.

- The result’s your take-home gross pay for that biweekly interval.

Right here’s an instance:

Let’s say you earn $15 per hour and work 80 hours in your month-to-month pay schedule (40 hours per week). Assuming no additional time and $100 in deductions, your gross biweekly pay can be:

$15 x 80 hours = $1,200

And your remaining take-home pay can be:

$1,200 – $100 in deductions = $1,100

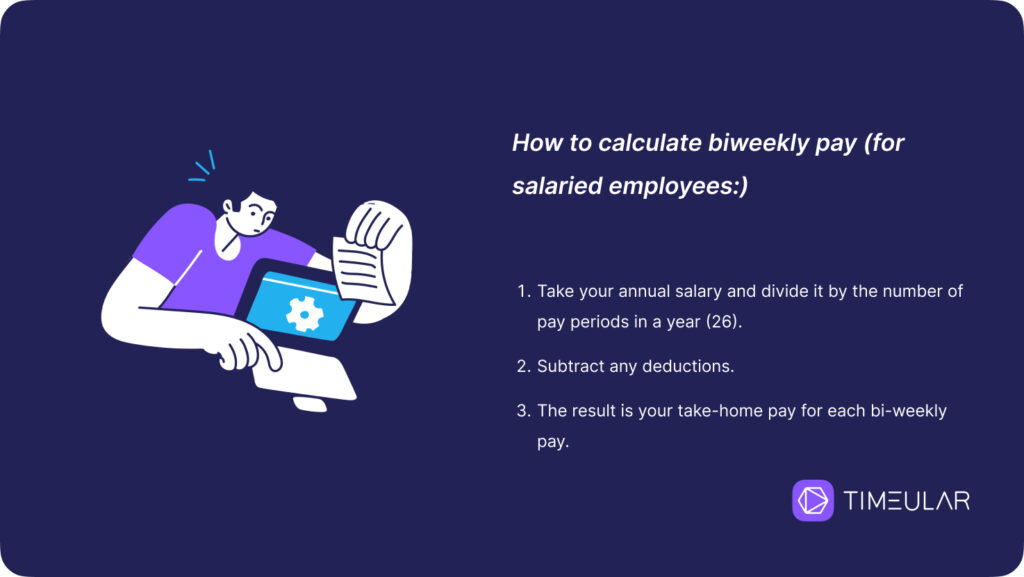

For salaried workers:

- Take your annual wage and divide it by the variety of pay intervals in a 12 months (26).

- Subtract any deductions.

- The result’s your take-home pay for every bi-weekly pay.

So in case your annual wage is $50,000 and you’ve got $150 in deductions every pay interval, your gross biweekly pay can be:

$50,000 ÷ 26 = $1,923.08

And your take-home biweekly pay can be:

$1,923.08 – $150 = $1,773.08

That’s easy, proper? Whether or not you’re hourly or salaried, the biweekly pay system follows the identical easy construction, simply with completely different inputs.

Industries with a bi-weekly pay schedule

When you may encounter bi-weekly pay in nearly any area, some sectors want and have to have a pay frequency in a biweekly pay schedule. Among the widespread ones are:

- Retail shops, eating places, and inns are processing their payroll in bi-weekly pay intervals, as the kind of workers working in such industries work by the hour. That is additionally because of the seasonality of those industries, and for his or her operational stream, it’s extra environment friendly to pay workers in biweekly pay schedules.

- Healthcare: Many medical practices, hospitals, and healthcare organizations go for bi-weekly payroll for his or her hourly and salaried workers. On this case, companies get a gradual money stream, and dealing with additional time monitoring is straightforward.

- Manufacturing and development are additionally no strangers to biweekly payroll processing. Typically, this business opts for a bi-weekly schedule because it suits their enterprise operations and rhythm of clocking in for shifts and dealing on particular tasks.

- Training: Academics, faculty directors, and help workers, particularly in public faculty programs, are sometimes on the bi-weekly pay interval, additionally attributable to seasonality. Furthermore, with so many workers to handle, biweekly pay streamlines payroll processing and retains issues working easily in such establishments.

There are extra industries with a bi-weekly pay schedule, as it’s a versatile choice. You’ll discover it in finance, skilled providers, nonprofits, and loads of different fields. It’s adaptable to a variety of enterprise varieties and sizes.

Biweekly vs. different varieties of pay schedules

Now that you just’ve acquired a strong grasp of biweekly pay, you may marvel the way it stacks up towards different widespread pay schedules. To focus on the important thing variations, let’s examine biweekly to weekly, semi-monthly, and month-to-month pay.

Biweekly vs. weekly pay schedule

On a weekly pay frequency, workers obtain paychecks from their payroll supplier each week, sometimes on the identical day (like each Friday). Right here’s the way it compares to biweekly:

- Frequency: Weekly pay leads to 52 paychecks per 12 months, whereas biweekly pays out 26 instances.

- Payroll processing: As an employer, you need to run payroll each week with weekly pay, which is time-consuming and expensive in comparison with the much less frequent biweekly schedule.

- Budgeting: As an worker, you could discover it simpler to finances with weekly pay as you obtain smaller, extra frequent paychecks that align with widespread weekly bills.

Biweekly vs. semi-monthly pay

Semi-monthly pay intervals imply workers obtain two month-to-month paychecks, often on particular dates like the first and fifteenth. How does it differ from biweekly?

- Frequency: Semi-monthly leads to 24 paychecks per 12 months, whereas biweekly yields 26.

- Pay dates: Semi-monthly pay all the time falls on the identical dates every month, whereas biweekly pay dates shift primarily based on the 14-day cycle (with the potential for “further” checks some months).

- Payroll processing: Employers run payroll much less incessantly semi-monthly than biweekly (24 instances vs. 26 instances per 12 months).

- Budgeting: As an worker, you may discover it simpler to finances with semi-monthly pay, as paychecks all the time arrive at predictable instances that align with widespread month-to-month payments (like hire or utilities).

Biweekly vs. month-to-month pay

One of the vital widespread pay schedules, month-to-month pay, because the identify implies, means workers obtain one paycheck per thirty days, sometimes on the final day of the month. Right here’s the way it measures as much as biweekly:

- Frequency: Month-to-month pay leads to 12 paychecks per 12 months, in comparison with biweekly’s 26.

- Payroll processing: Employers solely have to run payroll as soon as per thirty days with month-to-month pay, which saves money and time in comparison with biweekly.

- Budgeting: As an worker, month-to-month pay is typically difficult to finances, as it’s essential to stretch one paycheck to cowl all of your bills for the month.

- Money stream: Employers might wrestle with money stream with month-to-month pay, as they need to guarantee sufficient funds can be found to cowl a bigger payroll sum as soon as per thirty days.

There are each benefits and downsides to every pay interval for all events concerned. Select the kind of pay schedule that fits your wants and context. You possibly can prioritize the predictability of semi-monthly or month-to-month pay or admire the frequency and ease of additional time for biweekly or weekly pay.

Which cost schedule is finest for your enterprise?

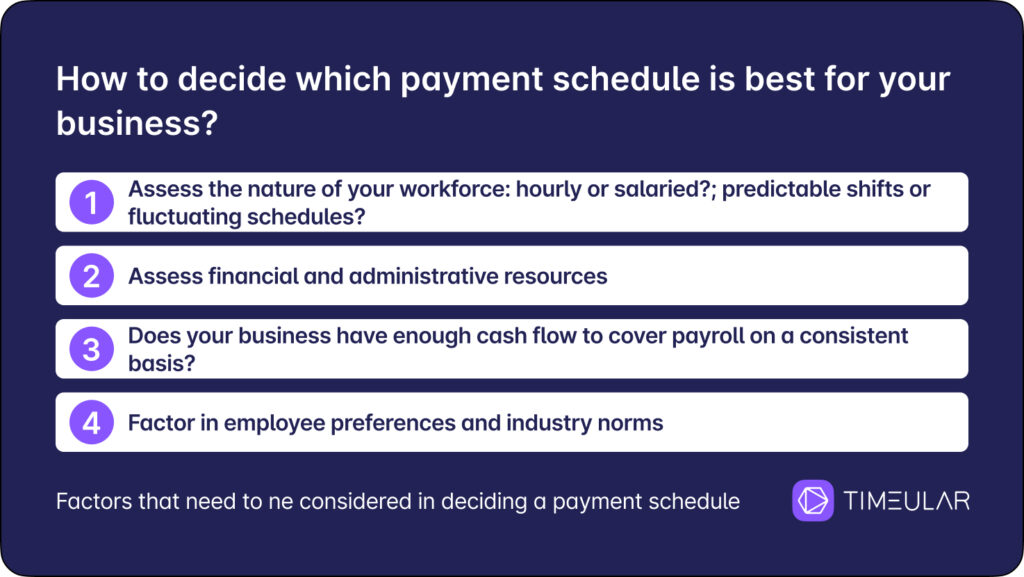

Relating to selecting a pay cycle, that you must think about many components to find out the suitable cycle. It’s typically not a one-size-fits-all, as what’s optimum on your group could be completely not appropriate for an additional.

- Begin with assessing the character of your workforce and deal with questions resembling: Are most of your workers hourly or salaried? Do they work on predictable shifts or have fluctuating schedules? These questions will level you towards a pay frequency that aligns together with your firm’s operational realities.

- Financials have an enormous position. Extra frequent pay cycles, resembling weekly or biweekly, would require extra administrative sources, whereas much less frequent schedules, resembling semi-monthly or month-to-month, could be extra environment friendly from a payroll processing perspective. Assess which one works finest for you.

- Money stream is one other key issue. Does your enterprise have sufficient money stream to cowl payroll on a constant foundation? You may discover it simpler to finances and handle money stream with much less frequent pay cycles or want biweekly or weekly pay’s regular, predictable cadence.

- Worker preferences and business norms. In some sectors, sure pay schedules are merely extra widespread and anticipated. For instance, as talked about above, biweekly pay is a normal in lots of retail and healthcare settings, whereas semi-monthly pay is extra typical in workplace environments. Staying aggressive in your business ought to be your precedence.

Finally, the “finest” pay schedule is the one which strikes the suitable stability for the distinctive wants of your organization and your workforce.

Sure or no to bi-weekly payroll?

As talked about above, when deciding on a bi-weekly payroll schedule, that you must weigh its advantages, drawbacks, and impression on your enterprise and workers.

As a remaining recap, you may have the next:

➕ On the plus aspect, bi-weekly payroll simplifies monetary planning for workers, as they obtain constant paychecks each two weeks. It reduces the frequency of payroll runs in comparison with weekly payroll.

➖ On the opposite aspect, for companies, it comes with extra issue managing payroll taxes and admin burdens, notably in calculating and monitoring additional time pay for workers with completely different schedules. Each additional time and tax reporting require you to diligently observe and report them to remain compliant. Furthermore, that you must account for months with three payroll intervals, which might pressure your money stream.

In the event you resolve to or are required to implement a bi-weekly payroll, you’ll be able to scale back the trouble through the use of automated payroll software program like Timeular. Timeular is a payroll tracker that helps you streamline payroll processing, observe time effectively, and reduce errors on this tedious course of.

In case your reply is “sure” to a payroll tracker, right here’s what it consists of for you:

- All-in-one system: Timeular routinely tracks work hours, additional time, and PTO, all in the identical app.

- Customizable reviews: With payroll monitoring software program, your bi-weekly timesheet reviews are generated routinely with only a few clicks, because it offers payroll groups with the precise information they want for every pay interval.

- Payroll and invoicing integrations: The software integrates with well-liked payroll and invoicing instruments, permitting you to simply switch worker hours information for payroll calculations. In the event you’re utilizing bi-weekly pay, guide timesheets are usually not an efficient choice.